Santa Fe, NM 87505

Which CECL model should we use? 23 Jul 2018

If you're a top 20 bank, this will almost certainly be a modified version of your CCAR model. For everyone else, we tested the alternatives.

This is an expansion of our previously released studies. In a sincere effort to assist small lenders in implementing CECL, several "spreadsheet methods" have been proposed.

- Historic averages: Compute the previous 12 month loss and prepayment rates and apply through the end of the loan.

- Vintage copy-forward: Take the annual loss rate in the previous year for the previous annual vintage and apply to the current annual vintage. (Copy last year forward for the previous vintage.)

- Hazard (Average by age): Align the vintages by age (months-on-book) and compute an average hazard function (aka lifecycle, loss timing function). Apply to all vintages.

- Time series (loss rate): Correlate previous loss rates to economics and project forward with an economic scenario.

- Roll rates: Correlate roll rates to economics and project forward.

- Age-Period-Cohort (Vintage): A statistically-based vintage model goes beyond the spreadsheet approaches to consider lifecycle, credit quality, and economic correlations.

- State transition: Predict the probability of account transition between each delinquency state, pay-off, and charge-off.

- Multihorizon discrete time survival model: A loan-level version of a vintage model with delinquency and other scoring factors included.

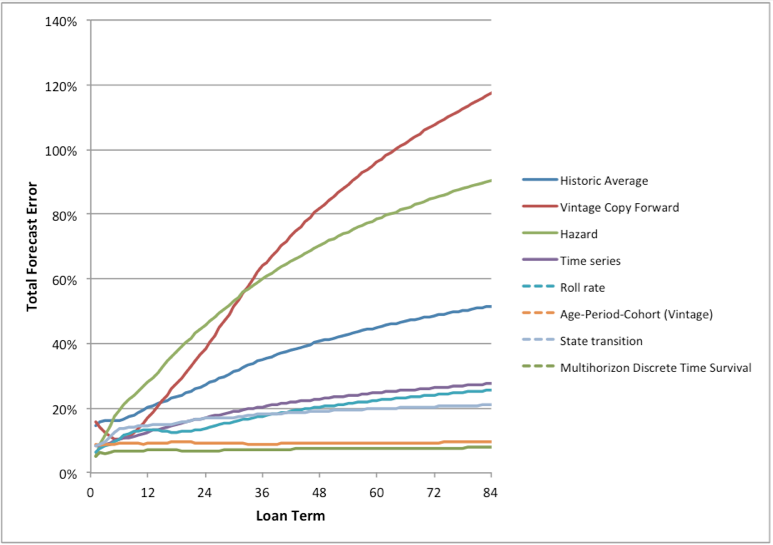

The graph shows the lifetime cumulative forecast error versus loan term for each model type. Although well-intentioned, the spreadsheet models are unusable for any product with a term >12m. They could be used as a base starting point before including lots of Q-factors, but that's not much of an improvement beyond the old ALLL rules.

Time series, roll rate, and state transition are all reasonable for short term loan types. For roll rate and state transition, they are particularly accurate for short term loans because of their reliance on delinquency, but delinquency is not a robust predictor for long term performance.

The clear winners for loan term loans (>12 months) are the vintage and discrete time survival models. This is due to the emphasis on estimating the lifecycle and credit quality by vintage, both of which have long term forecasting value.

These results hold true whether looking at in-sample or out-of-sample tests.

The greatest challenge for most lenders will be in trying to compare these methods on small data sets, since there is often not enough for a statistically value test. Hopefully the above results can aid in the consideration of which models to use.