Santa Fe, NM 87505

Current Loan Demand and Credit Cycle Trends 8 Aug 2018

The 2018 Q3 Senior Loan Officer Opinion Survey (SLOOS) was released on August 6th. While it won't make headline news, we pay close attention to the trends in consumer and commercial loan demand, and the trends are interesting.

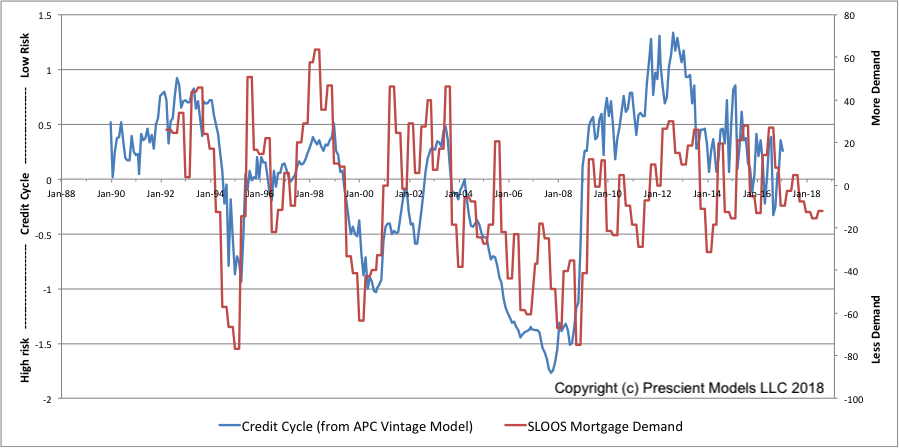

The following graph shows credit quality by vintage for mortgages (blue line) as measured using an Age-Period-Cohort model on Fannie Mae and Freddie Mac data. This is overlaid against the SLOOS mortgage demand index (red line). Historically, consumer demand for loans has been an excellent predictor of the credit quality of those loans. When demand is high, credit quality is good, because the good consumers are in the market. This is after adjusting for FICO. It's a measure of psychology.

For the last couple years, loan demand has been slowly declining and so has credit quality. These indices are now roughly equivalent to the situation we had in 2005 - sputtering along around average, but with the arrow pointed down.

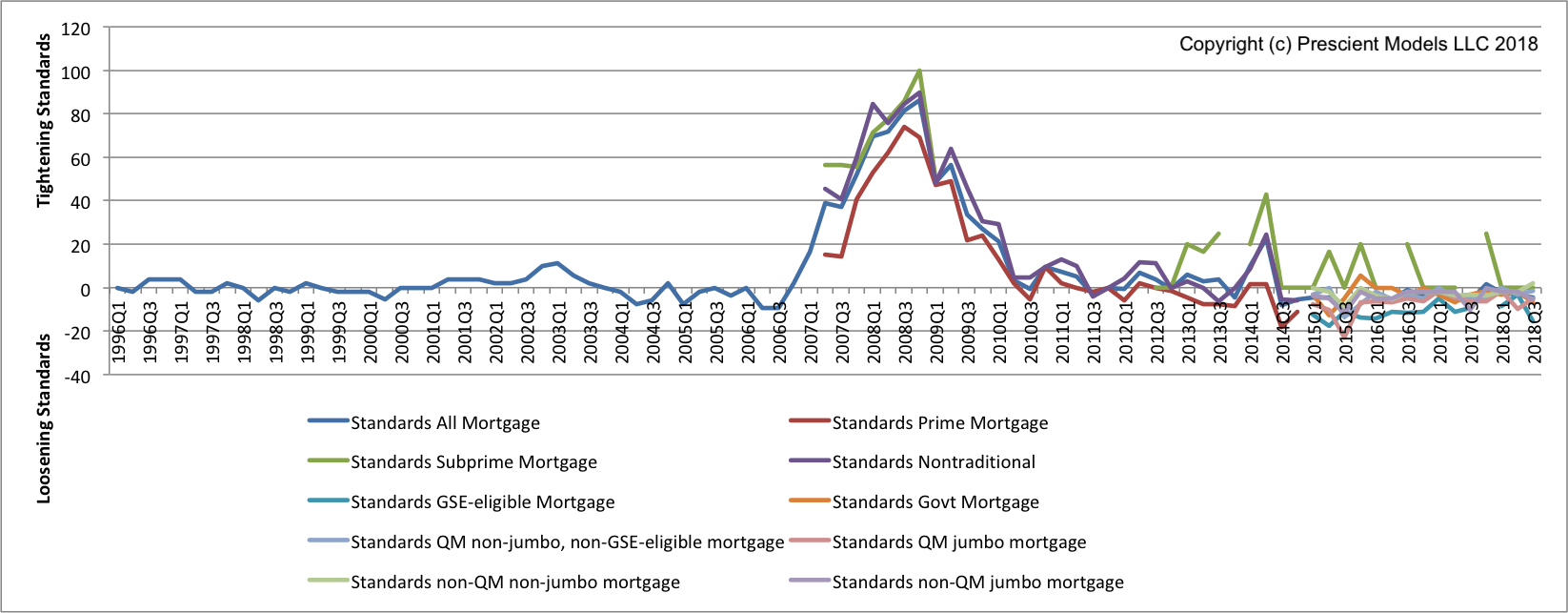

The SLOOS survey also provides lender-reported measures of underwriting changes. It shows that even though the observed credit cycle in mortgage is quite strong, it has little to do with underwriting standards... as reported by lenders. Underwriting is a process of choosing from those who apply. Underwriting policies cannot make good loans from poor applicants.

We cannot publish the credit cycle for other products, because we lack a public data set of the quality provided in mortgage. However, we can track the SLOOS loan demand indices to see where consumer risk appetite stands.

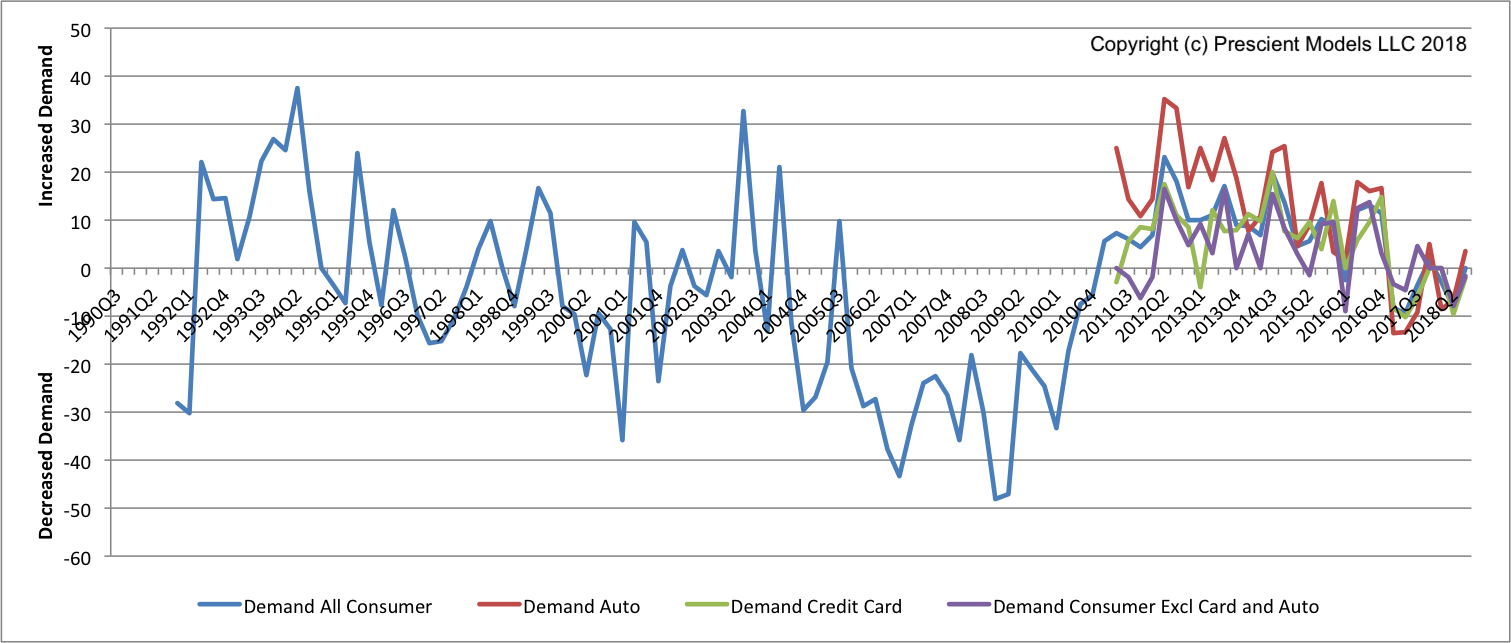

The following graph for consumer loan demand agrees with the mortgage demand result. In all loan categories, demand is neutral, which suggests credit quality is average as well.

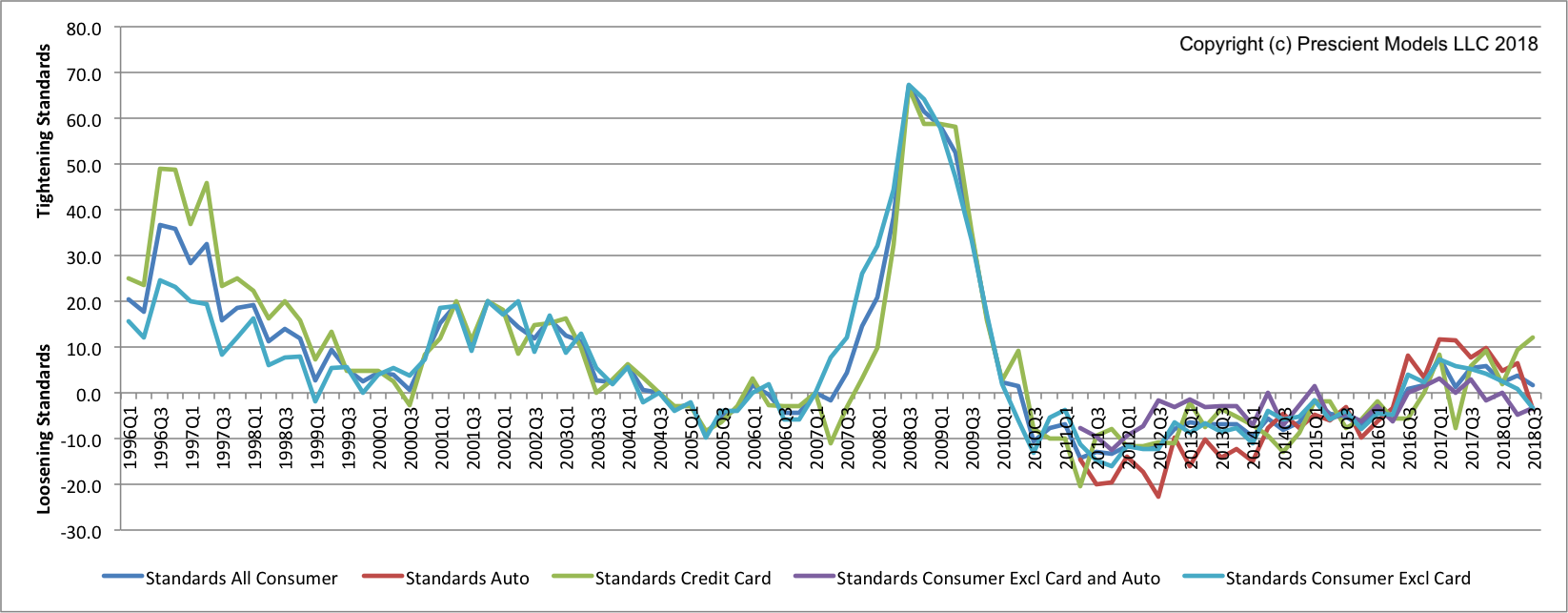

Lenders did make some underwriting changes in late 2016 and 2017 in response to the poor performing vintages in 2015. The poor 2015 vintage appears not to have been caused by consumer adverse selection but rather by overly exuberant underwriting, so the 2016-2017 correction (as 2015 losses were recognized) was warranted.

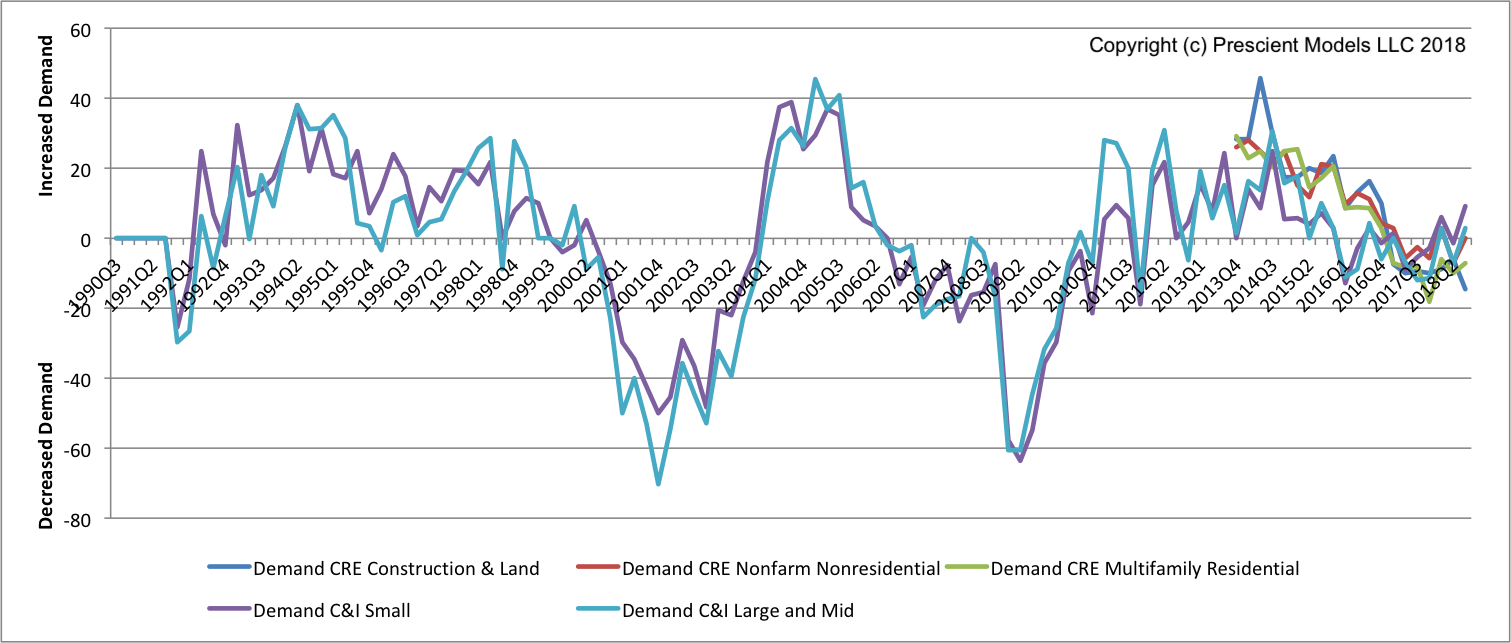

Unlike consumer demand, commercial loan demand has shown a little growth in the last year. The 2017 underwriting correction was even greater in commercial loans, but lenders are returning to a more aggressive position as loan demand has risen. If demand and credit quality correlate for commercial loans the way they do for consumer loans, this response by lenders is reasonable.

In summary, consumers are cautious but still with average demand and credit quality. Commercial trends appear to have shifted slightly, possibly due to recent tax changes. This view adds to what is being seen in yield curves - cautious, but not yet in decline.

The discussion here about cycles in loan demand and the credit cycle is explored in depth in a recent academic paper:

Breeden, J.L. and J.J. Canals-Cerdá, "Consumer risk appetite, the Credit Cycle, and the Housing Bubble", Journal of Credit Risk, 14(2), 2018, pp. 1-30.