Santa Fe, NM 87505

The Next Cycle, 12 Jul 2017

The Next Cycle

Loan portfolio management is like playing Jenga on a rocking ship. What looked like a good move yesterday could be a disaster today as the floor shifts beneath us. Therefore, we must always be looking for when the next wave will hit.

I am not an economist, but I know that everything we do is relative to a shifting economy. Loan pricing, account management, portfolio optimization all must look forward to the next phase in the economy. With that in mind, I would like to share a few simple observations for where we are today.

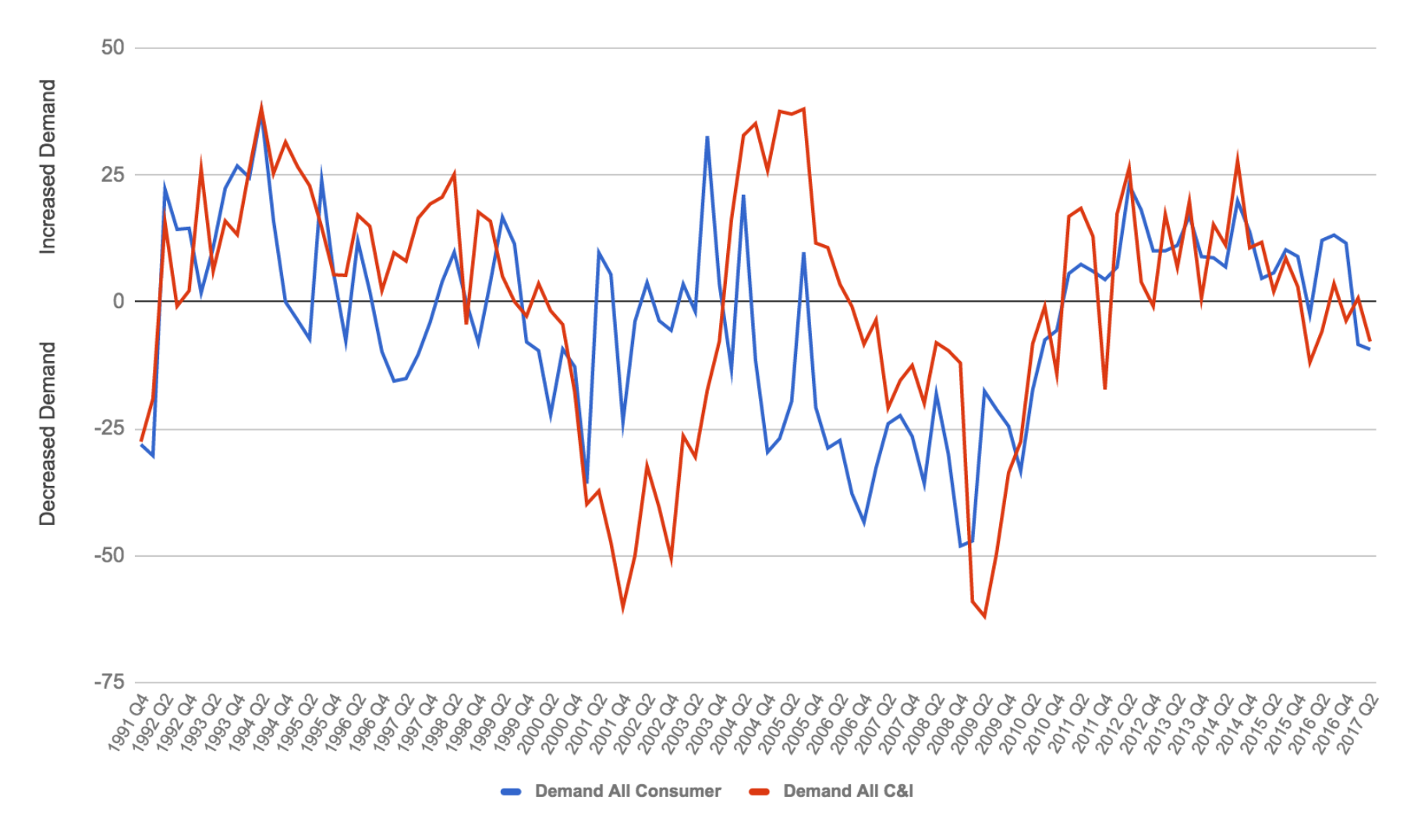

The Federal Reserve provides a quarterly Senior Loan Officer Opinion Survey (SLOOS) regarding questions about loan demand and underwriting practices. Unfortunately, the questions change somewhat over time, so to create an historical perspective, we went through old issues to create longer time series.

From previous research, we have learned to pay close attention to loan demand. When demand falls there is a risk of adverse selection in the remaining applicants. Furthermore, loan demand is a major driver of the economy. Given that, we should notice that demand for both consumer and commercial loans is falling in the most recent quarter. Following historic patterns, this could presage a recession within about 24 months, depending upon how lenders respond. Note that preceding the Great Recession, lenders responded to falling demand by pushing loans more aggressively. That delayed the recession but ultimately made it worse.

If you would like to receive a free copy of the spreadsheet collecting all of the historic SLOOS information, write to us. We have collected information from old reports into a single convenient file.

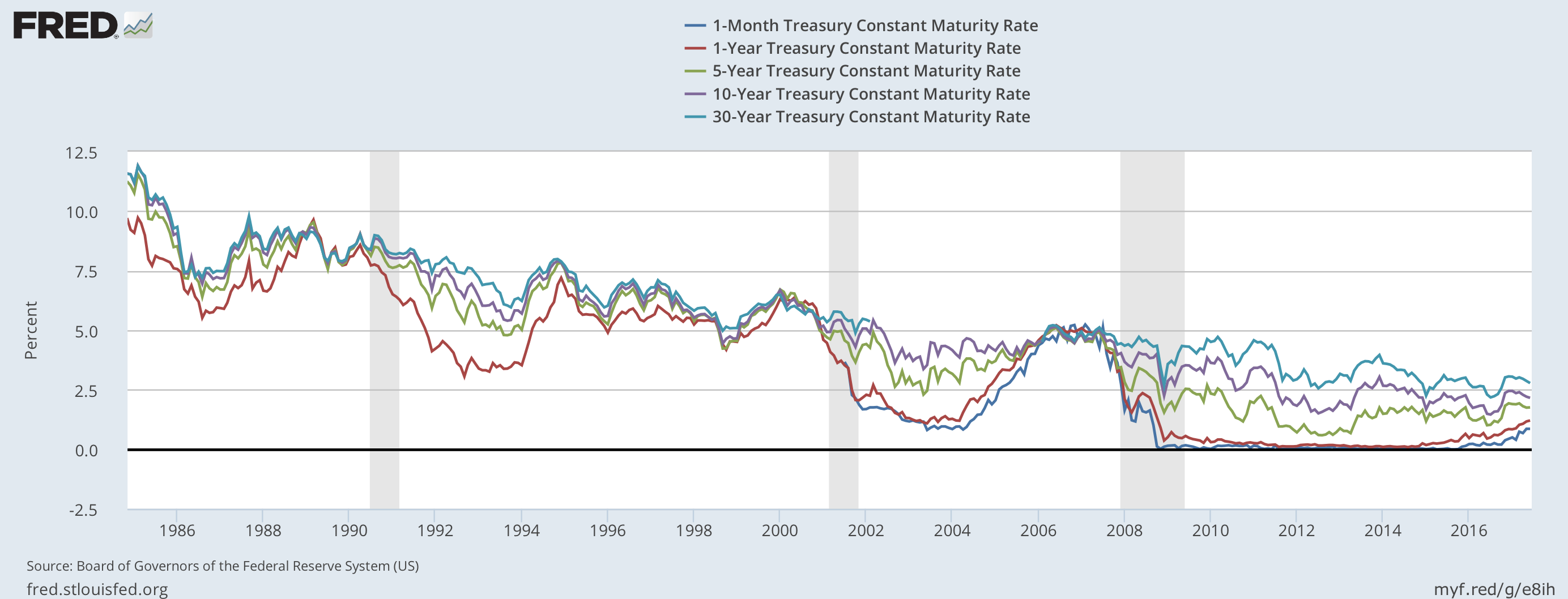

In addition, the yield curve is a classic early-warning indicator for the economy. The following graph from FRED shows that the yield curve is flattening. Again, following historic patterns, this could mean a recession within 24 months.

For these reasons, we are looking carefully with our clients at the scenarios and loss forecasts that go into loan pricing. Depending upon the average duration of the loan, do we need to reconsider the pricing, mix, or volume for new originations?